Best mortgage rates for poor credit

A credit score of 800 is necessary to get the best rates for Home Equity Line. Top Lenders in One Place.

Best Personal Loans Of September 2022 Forbes Advisor

Take Advantage And Lock In A Great Rate.

. However if your score is 500 to 579 be prepared to put 10 down. Those below 580 must. Ad 48 out of 5 customer rating.

Refinance Mortgage Rates For Poor Credit - If you are looking for lower monthly payments then we can provide you with a plan that works for you. 4 rows Cherry Creek Mortgage was founded in 1987. FHA loans FHA loans backed by the Federal Housing Administration are the most popular option for borrowers with bad credit.

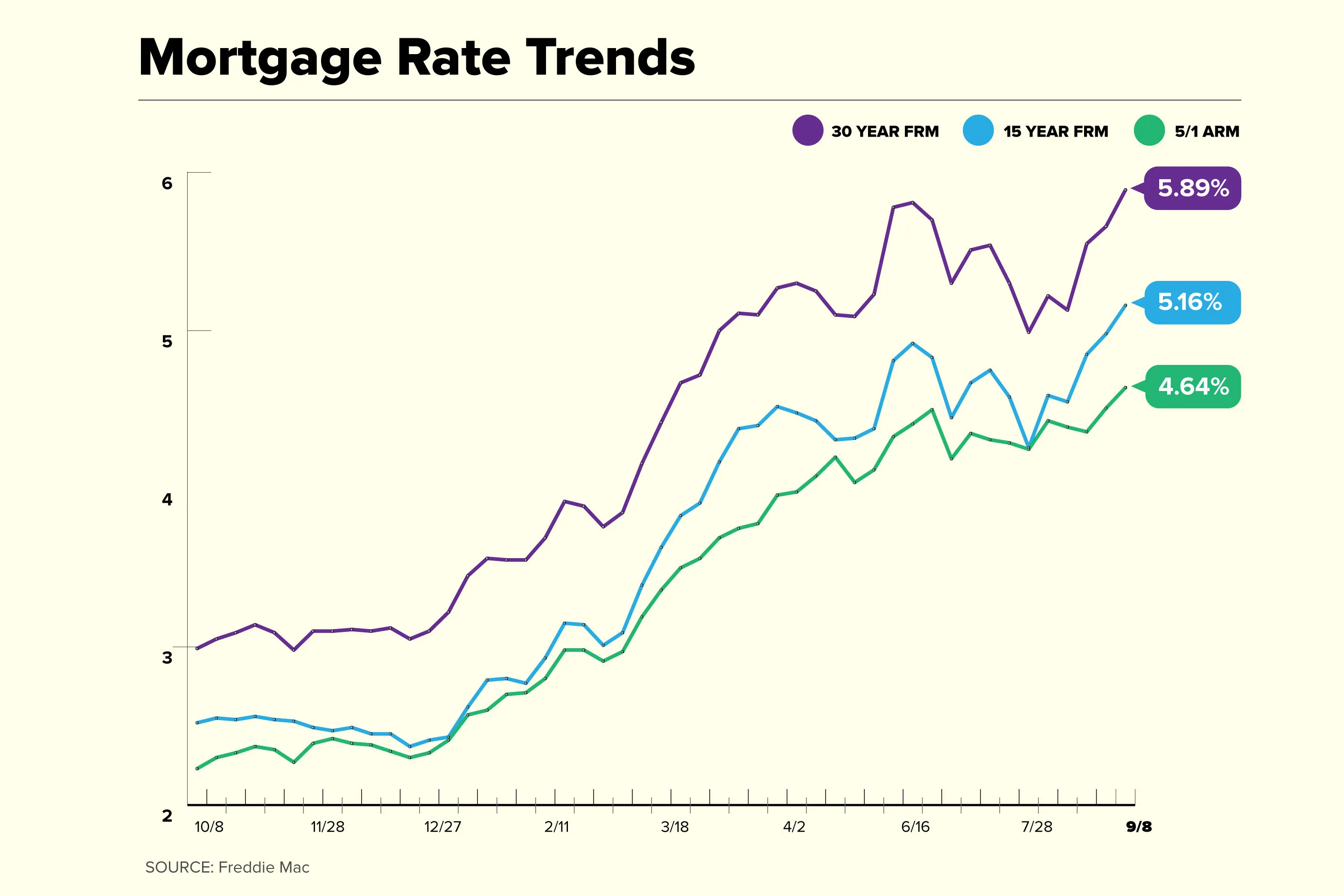

So lenders will look at the range in which your score falls and adjust your rate and fees. For today Tuesday February 15 2022 the average rate for a 30-year fixed mortgage is 420 an increase of 27 basis points since the same time last week. Lender Mortgage Rates Have Been At Historic Lows.

Save Real Money Today. The 30-year fixed mortgage rate on September 5 2022 is up 15. Make lenders compete and choose your preferred rate.

Top Lenders in One Place. Ad Dependable Experienced Helpful. Bank of America is moving forward with a 0 down payment mortgage program called the Community Affordable Loan Solution.

It can be difficult to compare bad credit mortgage rates as different deals will be available to you depending on your personal credit history. Bad credit refi refinance options for poor. Most borrowers need a minimum credit.

Deals that allow for CCJs and IVAs for example will. Over 8000 loans closed. Mortgage rates are generally based on your credit tier rather than your exact FICO score.

FHA loans are federally insured mortgages designed for low income borrowers. Compare Top Lenders Now. Those with credit scores above 580 qualify for a 35 down payment.

Introducing a new 0 down payment program. If you can put 10 down its possible to land an FHA mortgage with a credit score as low as 500. Lenders might ask that you have a larger deposit if you have bad credit for example around.

Even for an FHA loan with a. Ideally the monthly payment on your new mortgage loan principal interest taxes and insurance should total 28 or less of your monthly income though some lenders will go as high as 40. They can talk you through your options and help you find the best bad credit mortgage for your situation.

Discover 2022s Best Mortgage Lenders. Ad Find The Best Rates for Buying a Home. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates.

Try Our Secure Application Online. Retirement interest only mortgages. See all refinance rates.

The more deposit you have the better chance you have of finding a mortgage youre eligible for. Ad Compare Top 5 Bad Credit Mortgage Lenders for 2022. Ad Get mortgage rates in minutes.

Get 1 Step Closer to Your Dream Home. The difference between getting a mortgage with a 620 credit score and a 760 credit score boils down to 203 per month on your mortgage payments and 73263 on the total. 10 Best Bad Credit Mortgage Lenders for 2022.

See our Google Reviews Mortgages of Canada offers some of the best bad credit Mortgages available You may have seen us on CBC CTV Forbes and more. Ad Compare Top 5 Bad Credit Mortgage Lenders for 2022. Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments.

6 Since its inception the lender has originated over. You can get an FHA loan with a credit score as low as 500. World Class Customer Service.

Lenders dont usually advertise rates specifically for bad credit though. Ad Trusted Provider of Mobile Home Financing for 40 Years. Best variable rate mortgage deals.

Apply With VMF Now. 566 with 08 point up from 555 a week ago up from 287 a year ago. To get the best possible mortgage rates the borrower needs a credit score.

FHA Loan Credit Score Requirements. Compare up to 5 free offers now. Best 60 LTV mortgage rates.

Get a free quote in minutes. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. 30 Years of Mortgage Expertise.

10 Best Bad Credit Mortgage Lenders for 2022. Crypto Mortgage Plus. Best bad credit mortgage rates.

Taking the time to save up as much of a deposit as possible will give you access to better. Compare Offers Apply Get Pre-Approved Today. July 10 2022 The credit score needed for a mortgage depends on the type of loan.

The biggest factor in getting the best possible mortgage rates is the applicants credit scores. The current average 30-year fixed mortgage rate climbed 7 basis points from 570 to 577 on Monday Zillow announced. 498 with 08 point up from 485 a week ago up from 218 a year.

Compare Top Lenders Now. But you will probably have to work a little harder to find a lender. Best 90 LTV mortgage rates.

Lets cut to the chase - We will beat any quote or give you 250. At least 620 660. Best Mortgage Rates for Bad Credit of August 2022.

Bad Credit Loans 5 Best Lenders For People With Poor Credit

5 Best Mortgage Lenders For Bad Credit Of September 2022 The Ascent

What Is A Good Credit Score Forbes Advisor

Pin On Financial Services

:max_bytes(150000):strip_icc()/ProsperityHomeMortgage-d8dd786df01143ebb89246f7fb1658dd.jpg)

Best Mortgage Lenders For Bad Credit Of 2022

5 Best Loans For Bad Credit Of 2022 Money

Dk473yde2csrbm

Pin On Best Of Edmonton Real Estate

10 Best Instant Payday Loans With No Credit Check Get Online Cash Advance For Bad Credit 2022

How Your Credit Score Affects Your Mortgage Rates Forbes Advisor

Taking Mortgage Loans From Online Lenders Mortgage4 Calculator Refinancing Y Mortgage4 Calculator Refinancing Mortgage Loans Bad Credit Mortgage Lenders

Pin On Pinterest For Real Estate Marketing

What Is Considered Bad Credit Legacy Auto Credit

Pin Page

Agbo5fvxuoyi1m

5 Best Mortgage Lenders For Bad Credit Of September 2022 The Ascent

How To Get A Bad Credit Home Loan Lendingtree